17 Signs You Work With life insurance 99501

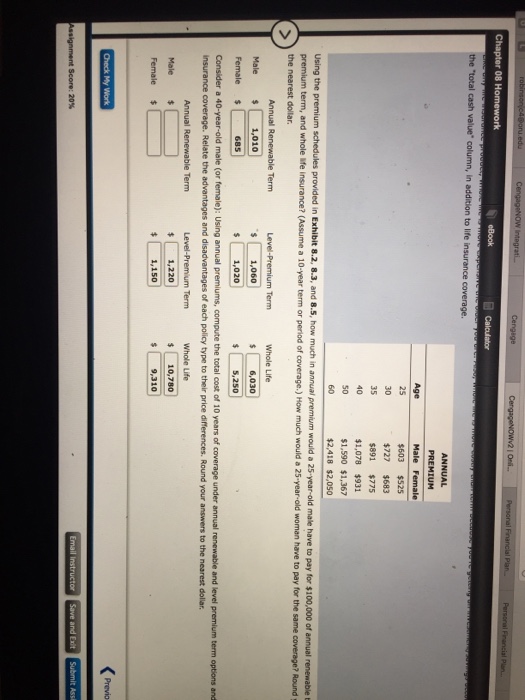

The Benefits of Life Insurance

Lots of people take out life insurance for a variety of factors. It is a means to offer some economic safety and security for the beneficiaries of an enjoyed one who has passed away. They might also be offering monetary protection on their own as they eagerly anticipate their very own gold years.

One more reason is that the private or pair wishes to continue to be financially stable when they pass away. In today's globe, with the price of living raising so promptly, some individuals are attempting to secure their financial future. Life insurance policy supplies a simple method to do this. Many individuals are not aware of the advantages of obtaining life insurance policy as a key advantage for the recipients of their will.

The factor you need to secure life insurance policy prior to you pass away is that it supplies some type of benefit for the beneficiaries if they can not handle their own money in the event of your death. This kind of insurance will pay your recipients' cash in a round figure, after you have died. This money can be used for any kind of variety of points, such as purchasing a house, university education http://www.bbc.co.uk/search?q=life insurance and learning, paying medical expenses, or any various other purpose that may arise.

The primary factor that the majority of people obtain life insurance is to supply earnings to their children. If you have no kids, after that you may intend to take into consideration getting life insurance policy on yourself. This can permit you to leave your cash to your partner or kids as well as obtain a few of your cash without needing to fret about just how they will have the ability to pay their costs when you no longer are around to do so.

People that choose to secure life insurance as a secondary advantage of their last https://en.search.wordpress.com/?src=organic&q=life insurance will and testament need to think about obtaining life insurance policy on their partner. You need to talk with your legal representative concerning your choices, but it can offer a simple way to supply some economic security for them after you have actually gone. Your life insurance plan can also cover you for any type of debts you may have against your estate.

The majority of people that secure a life insurance policy never ever obtain the policy on themselves. They just leave enough cash in the will to pay for their enjoyed ones. It is not uncommon for family members to utilize this plan as a means to give the beneficiaries of the will with several of the money that they would require to pay for their living expenses if you had actually not taken your life.

Some people that secure life insurance have plans to give a few of the money to their children after they pass away. If they do not die initially, they may not have a possibility to take the cash out as a result of an exceptional funding that they had actually obtained. Life insurance gives an easy means to do this.

Getting life insurance policy is not a risky thing to do, however there are points that you need to be familiar with. As an example, not all life insurance firms supply insurance coverage for all types of expenditures that people might incur after they pass away. They might not have the ability to pay for funeral expenditures, clinical costs, and also extra.

You ought to see to it that you are familiar with the sort of insurance coverage that you are getting prior to you join the populated line. The type of life insurance policy that you get should additionally be an excellent choice for your requirements.

When you acquire a life insurance plan, you ought to ensure that you look into the terms of the policy. The really initial point that you need to ask your representative or broker is what the benefits are that you will certainly receive for your policy. You need to recognize if the benefits are for your dependents, if you can assert a cash money value on the policy, or if it will settle any type of financial debts.

You will additionally require to consider whether you are going to get a term life insurance policy plan. Term life insurance policy is similar to the term life insurance policy that you obtain with a company, however you can assert the survivor benefit rather. You will additionally require to determine whether you wish to spend the money in some kind of IRA account, or a savings account, or a stock account.

To aid you pick between a term life insurance plan as well as an entire life policy, you should talk with a monetary expert or broker. They can give you ideas about which type of insurance coverage is right for you. and your circumstance.

Exactly how To Get The Most Effective Life Insurance Plan

Life insurance policy is one of the most essential facet of a retired life. It helps you pay for your enjoyed ones who have actually died as well as protects your liked ones from being left in the hands of insurance provider.

When you are intending to get insurance policy, it is excellent to take a look at what it can be used for as well as what cover it can supply. When you are aiming to get insurance in a different way than the typical, this will certainly aid you see to it that the plan that you are considering will be the appropriate one for you.

It is very important to find out the length of time the company has actually been in business and if they are trustworthy and also dependable. Some individuals might discover this info also tiresome, however if you want the most effective plan for your needs, you require to take the time to do the research study.

What should you consider when seeking life insurance? This is a question that many people don't think of, and also they believe that it must be economical, it should not set you back excessive, and that the company should have a great reputation.

There are lots of business that use affordable, inexpensive plans, however these typically only cover just the instant household. This is among the main factors that there are many individuals who end up paying for a plan that they do not actually require.

With a plan that will certainly cover your family for a particular quantity of cash on a monthly basis, you can conserve cash that you would certainly or else spend on various other things. It is tough to think about investing a thousand bucks a year, however if you are obtaining a life insurance policy for that amount of cash, you can consider doing it.

The other advantage about a life insurance policy policy is that it gives you comfort when you require it one of the most. You are shielded when you are not in your house, when you are taking a trip overseas, and also you can pay your expenses at the same time as you protect your family members.

As quickly as you are ended up paying for your life insurance policy plan you can unwind and not bother with anything since you have a safety net to fall back on. If you are wed, it will certainly shield you from divorce, if you have youngsters, it will shield them from having to leave residence, and also even if you are a smoker, it will certainly safeguard you from health problems that cigarette smoking can cause.

An insured life insurance plan is additionally a great financial investment. It can be used to fund the future of your household and need to be paid regularly so that your family members will have something to take place in instance of emergency.

Naturally, life insurance policy is not economical, yet the company will pay several of your costs if you are ill, a sufferer of criminal activity, or a sufferer of all-natural catastrophes. This is extremely useful to people that have actually shed whatever and also can not think about anything else yet fatality.

However, if you are considering getting a life insurance policy, see to it that it is the appropriate one for you. If you select a policy that has numerous loopholes as well as the business does not pay out on schedule, you will not be able to have comfort, as well as you will wind up being sorry for the choice you made.

As you can see, there are numerous means to obtain a life insurance policy policy. It will be an excellent suggestion to put in the time to compare a few different plans, discover which one fits your budget as well as requires the most, and then go with the policy that seems best to you.

Obtaining Life Insurance Policy Quotes Can Be Challenging

Although the concept of life insurance has actually been around for many years, many people are not aware of just how much they should spend for a policy. The quantity you spend for a policy is based upon a number of variables. You ought to be aware of these factors prior to acquiring a plan.

Your age will establish your insurance costs. More youthful individuals are more likely to enter an accident and for that reason pay higher costs. If you are older and also have no crashes, you may want to look into obtaining additional insurance coverage.

You can find various kinds of plans that cover various sorts of risks. As an example, you can include residence as well as materials protection to your current plan. This will assist safeguard you in the event of your residence being damaged by fire. If you have a second house, home and also contents can be included in the plan.

Prior to you acquire a life insurance plan, make certain that it fits your needs. Some plans are too expensive. You might want to look online and learn about the amount of protection you can obtain for the quantity of money you have budgeted for the policy.

Buying a life insurance policy plan can be tough. A broker will certainly aid you find a policy that is appropriate for you. When you have located a policy that you can afford, it will certainly be much easier to contrast the rates from different companies.

There are numerous on-line sources where you can obtain quotes from a variety of firms. You will have the ability to check each business's quote and determine which company is ideal matched for you. Compare the amount of insurance coverage offered by each business.

It is always a good idea to recognize your month-to-month expenditures prior to you buy a plan. Your family members may change in the future, and also this can affect the cost of life insurance. Discussing your costs with a broker may offer you a concept of what your costs would certainly be if you had the very same sort of protection in the future.

If you are seeking to get a policy with reduced premiums yet high interest rates, your plan may not appropriate for you. Life insurance policy is made to assist pay off your debts if you pass away. When you have a big debt, you will wind up paying greater interest rates on your plan.

When you are purchasing life insurance, you might wish to ask for a quote that consists of all of the costs that you would expect to pay for the cover. Some policies only cover medical expenditures as well as not funeral expenses. The two should be divided when you are looking for a policy.

In order to find the best insurance policy coverage, you ought to most likely to the office of a broker. A broker will certainly understand about the very best plans readily available and also will assist you compare the various costs that are offered. He or she can likewise help you to locate policies that consist of the insurance coverage you require.

Many times individuals fall short to look into the plan that they intend to acquire and also end up with a life insurance policy policy that they are not happy with. You ought to not sign up for a policy that you do not such as. Contrast policies to locate the one that best fits your needs.

The price of life insurance policy is a matter of prices. If you want a reduced price, you may want to look around as well as obtain quotes from several different companies. Obtaining insurance policy quotes can be a laborious procedure and also you might need to spend a day or more doing this.

Life Insurance Policy - Things to Know Before Getting a Policy

Life insurance is insurance for life. With that said being stated, you wish to see to it that you are obtaining the best bargain you can. This short article is a summary of what we have actually found so far. Please be aware that this is by no implies a complete checklist of life insurance coverage options.

There are hundreds of insurance policy providers. As you set about discovering the very best one for you, you may locate that particular products are not included in your plan. For example, some business will only cover pre-existing problems. You must call your agent or company regarding this and see if it is covered.

In addition to a few of the advantages discussed right here, it is very important to note that most people don't need the real insurance coverage that they claim to require. Many people assume that they do need this kind of insurance coverage. But really, it is important to understand that any kind of life insurance policy is just safeguarding you from the financial debts of your family members.

The insurance company would not offer you money for life insurance policy. They will normally request an annuity payment that will certainly be offered to your recipients in a lump sum. The lump sum quantity is small, however the settlements are substantial once the death benefit has been computed.

Although there are numerous options around, it is wise to look around and also talk to insurer. In this way you can locate the best offers and make sure that the coverage you obtain will certainly fulfill your requirements. It is also good to get the price quote from a number of various companies to compare and also find the most effective insurance coverage available.

Life insurance policy is required for a number of factors. The basic reason is simply to shield your future monetary condition. Yet there are various other advantages that individuals enjoy. In this short article we have several of those benefits.

The function of life insurance policy is to provide future defense. It is likewise developed to pay out if you pass away. So a fine example of why you may need life insurance is if you lose your job. If you need cash for a particular time period prior to you can obtain an additional job, after that you require to have some sort of insurance policy.

Since it is important to have correct life insurance coverage, it is vital to shop around and also get the best rate for your insurance coverage. In this write-up we have actually taken a look at the advantage of having a higher costs. As a matter of fact, many people will certainly make the blunder of selecting a reduced price policy since they can afford it. They typically discover that the costs is much higher than they anticipated.

Some sorts of protection can additionally help safeguard your house in the event of an emergency situation. This holds true if you shed your work and there is a flooding or fire that intimidates your home. In this situation you intend to get additional insurance coverage to make sure that you are not entrusted no monetary means to take care of the damages done to your house.

Another reason to acquire life insurance policy is to shield your possessions. Typically the family will market these properties to pay off bills if there are youngsters involved. This is a bad idea when it involves your life insurance policy.

Having your very own life insurance policy policy is very important. Lots of people buy them due to the fact that they know they will cover their kids's university education and learning, their retirement, as well as all of their youngsters. Additionally, they could select a more youthful beneficiary. Others might not also be sure what sort of protection they need.

For those that are simply starting out and also do not have a great deal of cost savings, a bit of life insurance policy coverage can be the difference in between life and also death. So, whether you are acquiring a policy for yourself or for a close friend or relative, please bear in mind the advantages that this sort of insurance coverage can provide. Consider the alternatives that are offered to you, since when it revives, you require to ensure that you are covered!

15 Best Twitter Accounts to Learn About v a life insurance

The Advantages of Life Insurance

Lots of people get life insurance policy for a variety of factors. It is a means to give some financial safety and security for the recipients of an enjoyed one that has passed away. They may additionally be giving economic safety for themselves as they eagerly anticipate their very own gold years.

An additional reason is that the specific or couple wishes to stay financially stable when they pass away. In today's world, with the cost of living raising so swiftly, some individuals are trying to protect their economic future. Life insurance policy provides a very easy means to do this. Many individuals are unaware of the benefits of getting life insurance policy as a main benefit for the recipients of their will.

The reason you ought to secure life insurance policy before you die is that it provides some sort of benefit for the beneficiaries if they can not handle their very own money in the event of your fatality. This kind of insurance will certainly pay your recipients' cash in a round figure, after you have passed away. This cash can be made use of for any kind of number of things, such as purchasing a house, university education and learning, paying clinical bills, or any various other function that may develop.

The main reason that the majority of people obtain life insurance is to supply income to their kids. If you have no kids, then you might want to take into consideration getting life insurance on yourself. This can enable you to leave your money to your spouse or youngsters and get a few of your cash without having to bother with just how they will certainly have the ability to pay their costs when you no longer are around to do so.

People that pick to take out life insurance as a secondary benefit of their last will and also testimony need to consider getting life insurance on their partner. You should speak to your lawyer regarding your alternatives, but it can give a very easy method to give some economic safety and security for them after you have actually gone. Your life insurance policy policy can additionally cover you for any financial debts you may have versus your estate.

Most people that get a life insurance policy policy never ever obtain the policy on themselves. They just leave sufficient cash in the will to spend for their liked ones. It is not uncommon for member of the family to use this plan as a method to offer the beneficiaries of the will with several of the cash that they would require to spend for their living expenses if you had actually not taken your life.

Some people that obtain life insurance policy have strategies to give some of the money to their kids after they die. If they do not die first, they might not have an opportunity to take the money out due to an exceptional financing that they had gotten. Life insurance gives an easy method to do this.

Taking out life insurance policy is not a shot in the dark to do, however there are points that you require to be knowledgeable about. For example, not all life insurance policy companies offer protection for all kinds of expenditures that individuals may incur after they pass away. They might not have the ability to spend for funeral expenditures, medical costs, as well as more.

You need to ensure that you know with the kind of insurance coverage that you are getting before you join the populated line. The kind of life insurance policy that you get must additionally be an excellent option for your needs.

When you buy a life insurance policy policy, you ought to make sure that you check out the conditions of the policy. The extremely first thing that you need to ask your agent or broker is what the advantages are that you will get for your plan. You require to understand if the benefits are for your dependents, if you can assert a cash money value on the policy, or if it will pay off any type of financial obligations.

You will additionally need to consider whether you are going to get a term life insurance plan. Term life insurance is much like the term life insurance policy plan that you get with a company, but you can claim the death benefit rather. You will certainly additionally require to choose whether you want to invest the cash in some kind of IRA account, or a savings account, or a supply account.

To aid you select in between a term life insurance plan as well as a whole life policy, you must speak with a financial expert or broker. They can provide you pointers about which sort of insurance is right for you. and your circumstance.

Exactly how To Obtain The Most Effective Life Insurance Plan

Life insurance is one of the most important facet of a retired life. It helps you pay for your loved ones that have actually died as well as safeguards your enjoyed ones from being left in the hands of insurer.

When you are preparing to get insurance policy, it is excellent to have a look at what it can be made use of for and what cover it can offer. When you are looking to get insurance policy differently than the typical, this will aid you ensure that the strategy that you are checking out will be the appropriate one for you.

It is necessary to find out how long the firm has been in business and also if they are credible and dependable. Some people might discover this info too tiresome, yet if you want the very best policy for your demands, you require to take the time to do the study.

What should you think of when searching for life insurance? This is a concern that many individuals do not think about, and also they assume that it should be economical, it shouldn't set you back too much, and that the business needs to have a great reputation.

There are a lot of firms that offer inexpensive, inexpensive policies, however these typically only cover only the instant family members. This is one of the main reasons that there are numerous people that end up spending for a policy that they don't truly require.

With a policy that will certainly cover your family members for a specific quantity of cash on a monthly basis, you can save money that you would certainly otherwise invest in various other points. It is tough to think about investing a thousand dollars a year, yet if you are obtaining a life insurance policy for that quantity of money, you can consider doing it.

The other advantage regarding a life insurance policy is that it provides you comfort when you need it the most. You are protected when you are not in your house, when you are traveling overseas, and also you can pay your costs at the exact same time as you protect your family.

As quickly as you are ended up spending for your life insurance policy you can relax and not worry about anything because you have a safety net to fall back on. If you are wed, it will protect you from divorce, if you have children, it will certainly secure them from needing to leave house, and also even if you are a cigarette smoker, it will certainly secure you from health problems that smoking cigarettes can trigger.

An http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/life insurance insured life insurance policy plan is likewise a great financial investment. It can be used to money the future of your family members as well as should be paid on a regular basis so that your household will have something to go on in instance of emergency.

Obviously, life insurance policy is not cheap, yet the business will certainly pay some of your costs if you are ill, a target of criminal offense, or a victim of all-natural disasters. This is really valuable to people that have lost every little thing and also can not http://www.thefreedictionary.com/life insurance think about anything else but death.

However, if you are considering obtaining a life insurance policy, see to it that it is the best one for you. If you select a plan that has numerous loopholes and the firm does not pay on schedule, you will certainly not be able to have assurance, and you will certainly end up regretting the decision you made.

As you can see, there are numerous ways to obtain a life insurance policy policy. It will certainly be a great idea to make the effort to compare a few different policies, find out which one fits your spending plan as well as requires the most, and afterwards select the plan that appears ideal to you.

Obtaining Life Insurance Policy Quotes Can Be Testing

Although the idea of life insurance has been around for many years, many individuals are not knowledgeable about how much they ought to pay for a plan. The quantity you spend for a plan is based on a number of aspects. You need to know these elements before getting a policy.

Your age will certainly determine your insurance coverage costs. Younger people are more probable to enter an accident and as a result pay greater costs. If you are older and also have no mishaps, you might wish to explore getting added insurance coverage.

You can locate various types of policies that cover various sorts of threats. As an example, you can add house as well as contents coverage to your present plan. This will certainly help secure you in case of your house being ruined by fire. If you have a 2nd residence, house and also components can be added to the policy.

Before you acquire a life insurance policy policy, make certain that it fits your demands. Some plans are too costly. You might intend to browse online and also learn about the quantity of insurance coverage you can get for the quantity of cash you have allocated the plan.

Shopping for a life insurance policy policy can be challenging. A broker will help you find a plan that is right for you. When you have discovered a plan that you can pay for, it will be much easier to contrast the rates from different business.

There are different on the internet sources where you can get quotes from a variety of business. You will certainly have the ability to check each business's quote and determine which firm is finest fit for you. Contrast the quantity of insurance coverage provided by each business.

It is constantly a good concept to understand your month-to-month expenditures before you look for a policy. Your family may alter in the future, and this can impact the cost of life insurance. Discussing your expenses with a broker might offer you a concept of what your premium would certainly be if you had the exact same type of coverage in the future.

If you are seeking to buy a policy with low costs yet high interest rates, your policy might not be suitable for you. Life insurance is designed to help settle your debts if you die. When you have a big financial debt, you will certainly wind up paying greater interest rates on your policy.

When you are buying life insurance, you might intend to request a quote that consists of all of the expenses that you would certainly expect to spend for the cover. Some policies only cover medical expenditures as well as not funeral service expenses. The two must be separated when you are searching for a policy.

In order to locate the very best insurance policy protection, you need to most likely to the workplace of a broker. A broker will learn about the very best plans available and will certainly help you contrast the various costs that are readily available. He or she can additionally assist you to find policies that include the protection you need.

Many times people stop working to investigate the policy that they intend to buy and also end up with a life insurance policy plan that they are not pleased with. You must not register for a plan that you do not like. Contrast policies to locate the one that ideal fits your demands.

The expense of life insurance is a matter of pricing. If you want a lower rate, you may wish to search as well as get quotes from a number of different companies. Obtaining insurance policy quotes can be a tiresome process and also you might require to spend a day or two doing this.

Life Insurance - Things to Know Prior To Obtaining a Policy

Life insurance is insurance coverage forever. With that said being stated, you wish to see to it that you are getting the very best deal you can. This post is a recap of what we have located until now. Please understand that this is by no means a full checklist of life insurance policy coverage alternatives.

There are hundreds of insurance coverage carriers. As you go about locating the best one for you, you may locate that certain products are not consisted of in your policy. As an example, some companies will only cover pre-existing problems. You should call your agent or business regarding this and see if it is covered.

Along with some of the benefits discussed here, it is very important to note that most people do not require the actual insurance policy protection that they claim to require. Lots of people assume that they do require this kind of insurance coverage. Yet really, it is important to realize that any kind of life insurance policy is only safeguarding you from the financial debts of your family.

The insurer would certainly not provide you cash for life insurance policy. They will normally request an annuity settlement that will be provided to your beneficiaries in a round figure. The round figure amount is small, however the payments are massive once the survivor benefit has actually been calculated.

Although there are so many alternatives available, it is a good idea to search and speak with insurance provider. This way you can discover the very best offers and see to it that the coverage you obtain will fulfill your demands. It is likewise wonderful to obtain the rate quote from numerous various business to contrast as well as find the very best protection available.

Life insurance is needed for a variety of reasons. The fundamental reason is merely to safeguard your future financial condition. But there are other advantages that individuals take pleasure in. In this short article we have some of those advantages.

The objective of life insurance is to give future security. It is likewise developed to pay out if you pass away. So a fine example of why you may need life insurance policy is if you lose your work. If you need money for a certain time period before you can obtain another job, then you need to have some type of insurance coverage.

Due to the fact that it is important to have proper life insurance policy protection, it is crucial to look around as well as obtain the very best rate for your insurance coverage. In this article we have looked at the advantage of having a greater premium. In fact, lots of people will make the mistake of choosing a low price policy because they can afford it. They typically learn that the premium is a lot more than they expected.

Some kinds of protection can likewise assist shield your house in the event of an emergency situation. This is true if you shed your job as well as there is a flood or fire that intimidates your residential property. In this circumstance you want to obtain additional protection to make sure that you are not entrusted to no economic methods to repair the damage done to your house.

Another factor to acquire life insurance is to safeguard your possessions. Often the family members will market these possessions to pay off expenses if there are kids included. This is a negative suggestion when it pertains to your life insurance.

Having your own life insurance policy policy is very important. Many people buy them because they understand they will certainly cover their children's university education, their retired life, and all of their kids. Also, they might select a younger beneficiary. Others might not even be sure what kind of insurance coverage they need.

For those who are just beginning and do not have a lot of financial savings, a little bit of life insurance policy coverage might be the difference between life and also death. So, whether you are acquiring a plan on your own or for a close friend or loved one, please remember the advantages that this sort of insurance can offer. Consider the options that are available to you, because when it comes to life, you need to make certain that you are covered!

3 Common Reasons Why Your sales process of life insurance Isn't Working (And How To Fix It)

Types of Life insurance policy as well as theBenefits of Each

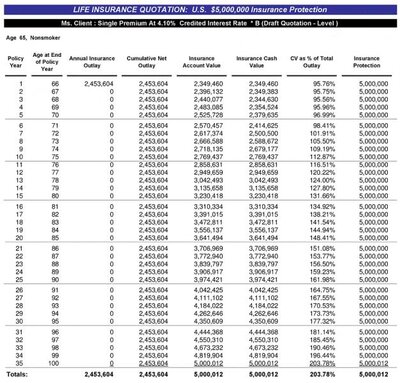

Life insurance is the quantity you pay to have the insurer payout your loved ones money if you are unable to pay them for a certain amount of time. If you are provided a death benefit, then this is cash that can be paid to the beneficiary. If you pass away, the beneficiary will obtain a round figure amount.

The costs permanently insurance are exceptionally costly; some insurance provider call for as much as 75% of the death benefit to be paid within the initial year. The settlements might additionally be surrendered right into the 2nd year. You can also select from a repaired or variable rate plan.

To determine your risk, you will certainly need to know your level of risk. A lower threat individual is a higher costs and greater risk individual is a lower premium. This is all depending on the type of coverage you choose to obtain. There are four primary sorts of insurance; House insurance, Personal Insurance coverage, Term Life Insurance, as well as Whole Life Insurance.

Term Life Insurance Policy - Term Life Insurance Policy is the least pricey kind of insurance for you. When you obtain a Term Life Insurance Plan, you will certainly make money back after you die. This is due to the fact that the survivor benefit is paid right away. With term life insurance policy, the death benefit is adjusted month-to-month based upon the current market rate of interest. One more good thing https://en.search.wordpress.com/?src=organic&q=life insurance about term life insurance is that the costs are usually a lot lower than the other kinds of insurance coverage, which conserves you money.

Whole Life Insurance Policy - Also referred to as Endowment Life Insurance, Whole Life insurance policy enables you to buy an endowment of your life and repay the plan monthly. After you pass away, the policy will certainly pay the recipient according to your survivor benefit amount. This is the most pricey form of insurance coverage, and typically features a large costs.

Short-Term Policy - Thesepolicies just cover you for a certain amount of time. They offer no death benefit and are much more costly than term plans. Short-term policies are used to give coverage throughout emergency situations or to settle any kind of financial debts you may have, generally discovered in your home mortgage.

Third Party Vehicle Insurance coverage - Insurance coverage can be either straight (where the insurance policy service provider pays the insurance claim) or Indirect (where you pay the case). Indirect coverage will pay the plaintiff in a round figure payment if you die, as well as this can be tax obligation insurance deductible.

Indemnity - This coverage offers you protection to your household, including your house, cars, furniture, and so on. It can be bought directly from the insurer or you can have it financed.

Property Coverage - Coverage is typically bought from the same firm that guarantees your residence. These plans generally do not use death benefits.

Catastrophic Defense - When you get disastrous insurance coverage, you get insurance to safeguard you from loss of revenue because of illness or unemployment. It is usually non-income bearing, though, so if you lose your job, the premium will still be paid to you.

Long-Term Care Insurance Coverage - Long-lasting treatment insurance is useful if you have a condition that requires you to stay in a hospital or retirement home for prolonged amount of times. There are a selection of conditions that might get this protection, consisting of Alzheimer's condition, Parkinson's illness, Autism range problem, Lou Gehrig's illness, Huntington's illness, as well as several sclerosis.

Various other Insurance coverage - You can likewise get term life insurance policy that provides protection for funeral costs, medical expenses, traveling expenses, as well as some special needs benefits. Some insurance companies use discounts for buying your plan through their insurance representatives. You must ask about every one of your choices and after that make the decision that best fits you.

Tips For Getting the very best Life Insurance Fees

Life insurance policy is an unpreventable requirement, especially for those who prepare to leave their household or companies behind as well as their economic affairs. The options readily available are lots of and also usually can be confusing, especially if you are acquiring insurance coverage for the first time.

There are several aspects that need to be thought about when purchasing insurance policy such as the individual's needs, the individual's age, the individual's work, the individual's occupation, and obviously the person's personal finances. There are, however, some points you can do to lower the number of firms you will certainly need to take care of. Below are a couple of tips.

The most essential point you can do is to investigate the companies. You can find this by browsing the net for internet site that sell life insurance policy. You will certainly be able to get a good review of the various plans as well as how they are priced. On top of that, you will certainly be able to compare business to figure out which one uses the very best advantages.

Particular life insurance policy service providers have actually been recognized to offer the most effective worth for cash because they have excellent record as well as are not known for high costs. If you are seeking an excellent company with great customer service, you must try to find companies that have less than 50 issues against them. Keep in mind, you only require insurance coverage if you are mosting likely to pass away so it is essential that you obtain what you pay for.

An additional suggestion is to guarantee that you buy insurance from a firm that has your current postal code. This implies that any type of claims will certainly be taken care of the like if you were to buy insurance coverage from one more company. You will also have the ability to look around even more conveniently because the plan will certainly be sent directly to you.

Investigating online for life insurance policy is extremely crucial. This is since there are lots of business that use excellent life insurance at reduced prices. Many people only learn about these firms after they have actually made a policy choice and so it is important that you do some study prior to you choose.

One more idea to think about is to make the most of life insurance contrast tools and calculators that can be discovered on the internet. This can help you contrast the numerous plans as well as policies that are available.

Bear in mind, that you need to do a good quantity of research before you pick a life insurance service provider. Picking a reliable company that is licensed to provide life insurance in your location is an excellent way to be sure that you are receiving the insurance coverage you need.

Among the most effective methods to search for low prices is to use your neighborhood yellow web pages. The majority of local phonebook have a section committed to insurance policy, so you ought to have no problem locating a service provider that can give you with the insurance policy you require.

It is a great concept to ask a broker for suggestions too. Brokers benefit the insurer and know which policies they like best. They are professionals in this area and can typically obtain you a great price even if you are a new client.

Before you purchase life insurance plans, you should consider all of your choices. Many individuals find that they are better paying a higher premium than buying plans from a solitary company. It is difficult to change providers when you have a great partnership with one yet this is not constantly feasible.

Bear in mind, the very best choice is to obtain a reduced costs for a long period of time, particularly if you understand you will certainly be around. You should also take into consideration changing when you have had a few years with the service provider.

Getting A Life Insurance Policy Quote

It is important that when you get life insurance quotes, you discover a firm that does not discriminate against your age or sex. Ladies and young people go to a greater threat for fatality due to the health problems they are vulnerable to. In order to shield your loved ones, it is important that you get a life insurance policy quote for a lady.

It is essential that when you get life insurance policy quotes, you locate a company that gives life insurance policy plans that will supply advantages in case of the death of the insured person. Your family members will not be left on an empty leg of bread in instance of your fatality, but they will receive assistance in the event of your death.

When you get a life insurance policy quote, you have to likewise make sure that you locate a company that provides affordable prices. It is vital that you find a plan that will certainly supply excellent protection for you at a reasonable rate. You intend to get a price cut for choosing to guarantee your enjoyed ones as opposed to on your own.

If you want a life insurance policy quote as well as are a younger grownup, you ought to make certain that you do not obtain a strategy that is also hostile. You wish to know that you are guaranteeing your family members in situation of your fatality. This is why it is important that you find a strategy that will offer a bargain of protection.

You might desire to ask for a complimentary quote from a life insurance company. This is an excellent way to see what is offered for you and how much you will be anticipated to pay for your policy. A number of suppliers supply complimentary quotes, so this is an excellent way to obtain a strategy that can save you cash when you require life insurance.

When you are looking for a life insurance policy quote, you may locate that you are required to obtain a credit history check prior to they will certainly provide you a quote. This is a need that is set by legislation. You will be needed to prove that you are a good danger for the life insurance policy firm to buy the plan from.

Lots of insurance companies that provide life insurance policy estimates on the Internet base their rankings on how much cash a client has actually paid into a savings account. In this circumstances, the policy owner is taken into consideration a great risk and the business wants to ensure that they will certainly not have to pay any expense expenses for fatality or clinical costs. This is one manner in which the firm can assure they will certainly earn money in the event of an individual's fatality.

If you have a bad credit report, you must make an application for a policy asap. When you apply for a quote, you will be asked if you presently have a life insurance policy plan. If you do, they will certainly see if you have a low https://www.washingtonpost.com/newssearch/?query=life insurance credit report and if so, you will be asked to submit a credit record before they will certainly use you a life insurance quote.

It is not uncommon for a plan holder to invest a long time in waiting before they get a quote. Numerous providers only ask for a quote when a plan is ready to be restored. In various other instances, they will certainly obtain a copy of your credit history record to determine if you fulfill their guidelines for paying right into an account. You must permit yourself adequate time to experience a credit history record prior to you are provided a quote.

If you need a quote right away, you must try to obtain one by mail. This is the quickest means to receive a quote. Some companies may contact you to get even more details about your plan. This is a better option than applying for a quote face to face.

After you obtain a quote, you need to read it meticulously. There are certain components that need to be included in a quote that will assist you choose whether it is ideal for you. In some cases, you may have the ability to improve prices if you have a minimum quantity of life insurance policy.

The best way to get a complimentary life insurance policy quote is to make use of the Internet. There are several internet sites that will certainly offer you a complimentary quote forever insurance policy. You will certainly after that have the ability to make an educated choice as to whether a life insurance policy quote is right for you.

The Sorts Of Life Insurance Available out there

We all need to have listened to the term life insurance. It is a type of defense plan that can be acquired from a 3rd party. You pay costs each month to an insurer as well as in situation of your fatality, the insurance company pays you the death benefits.

Life insurance is a life preserving insurance policy cover. The marketplace for life insurance coverage varies with different plans and alternatives. Different life policies, depending upon their terms and conditions, enable you to gain access to various type of policy alternatives.

There are some usual sorts of life insurance policy on the market. Permanent life insurance is one such type. It protects against loss of income in case of fatality or inability of the insured to function. It provides you with funds to replace your lost earnings in situation of any sort of monetary distress.

Most of permanent life insurance includes a low premium. In some cases, they come with a low set rate of return. Such policies commonly come with a number of benefits like fee-for-service.

A person can choose a variable life insurance policy. This plan includes higher costs however has a reduced threat premium. It also comes with a variable rate of return that can aid adjust the premium.

A person can opt for a short-term insurance. This plan is normally a conventional type of life insurance. However, it is most suitable for individuals who have funds readily available just for a few years.

Short-term insurance coverage can be obtained from a business or person. If you select short-term insurance coverage, you can save cash because the policy will certainly not feature a recurring cost.

There is a periodic plan. Such a policy comes with a reduced annual premium. This is additionally very excellent for people with adequate money to invest.

Mutual life insurance is an exceptional way to safeguard yourself from the threats of getting life insurance. Shared insurance policies are cost-effective and also featured the added benefit of an insurance company that covers your death benefits.

To recognize this clearly, let us take an example of a lady who buys a life insurance policy policy from an insurance provider to replace her partner's pension. After she passes away, the beneficiary would obtain some income, which she or he can utilize to pay his/her costs.

Here, the beneficiary can offer common insurance to obtain funds needed to pay his or her bills. Given that common insurance is budget-friendly as well as covers the death benefits, it is an economical alternative.

A broker is usually associated with the life insurance policy procedure. He assists you in choosing the very best policy to fit your demands. This broker supplies extensive coverage in addition to preparing help.

Will excess life insurance table 2015 Ever Die?

The Advantages of Life Insurance Policy

Lots of people get life insurance policy for a selection of reasons. It is a means to provide some economic protection for the beneficiaries of an enjoyed one who has actually passed away. They may likewise be offering monetary safety for themselves as they eagerly anticipate their very own golden years.

An additional reason is that the individual or pair wants to continue to be financially stable when they die. In today's globe, with the cost of living raising so swiftly, some individuals are attempting to protect their financial future. Life insurance policy supplies an easy means to do this. Many people are uninformed of the advantages of getting life insurance policy as a main advantage for the beneficiaries of their will.

The factor you ought to obtain life insurance prior to you pass away is that it gives some kind of benefit for the recipients if they can not handle their own cash in case of your fatality. This type of insurance will pay your recipients' cash in a lump sum, after you have passed away. This money can be utilized for any number of things, such as purchasing a residence, college education and learning, paying clinical bills, or any type of various other purpose that might arise.

The major factor that lots of people obtain life insurance policy is to give revenue to their children. If you have no youngsters, after that you might want to consider obtaining life insurance policy on yourself. This can allow you to leave your cash to your partner or kids as well as get several of your cash without having to fret about just how they will be able to pay their expenses when you no more are around to do so.

People that choose to get life insurance as a second benefit of their last will as well as testimony must think about securing life insurance on their partner. You ought to speak to your attorney concerning your alternatives, yet it can give an easy means to give some financial safety for them after you have gone. Your life insurance policy can also cover you for any financial obligations you might have versus your estate.

Most individuals that secure a life insurance policy plan never ever take out the plan on themselves. They merely leave adequate money in the will to spend for their loved ones. It is not uncommon for family members to use this plan as a means to provide the beneficiaries of the will with some of the cash that they would certainly require to pay for their living costs if you had actually not taken your life.

Some individuals who obtain life insurance have strategies to give several of the money to their youngsters after they die. If they do not die initially, they might not have a pw

15 Best Pinterest Boards of All Time About life insurance broker portsmouth

The Benefits of Life Insurance Policy

Lots of people secure life insurance policy for a variety of factors. It is a way to offer some monetary security for the beneficiaries of a liked one that has actually died. They might likewise be supplying financial protection for themselves as they anticipate their very own gold years.

Another reason is that the individual or couple wants to remain financially stable when they pass away. In today's globe, with the cost of living raising so rapidly, some individuals are trying to protect their economic future. Life insurance supplies a simple way to do this. Lots of people are uninformed of the benefits of getting life insurance policy as a primary benefit for the beneficiaries of their will.

The factor you must obtain life insurance prior to you pass away is that it supplies some sort of advantage for the recipients if they can not manage their own cash in case of your death. This kind of insurance policy will pay your beneficiaries' money in a round figure, after you have passed away. This money can be used for any type of number of points, such as acquiring a residence, college education, paying clinical costs, or any type of other purpose that might develop.

The major reason that most people get life insurance policy is to supply income to their kids. If you have no youngsters, then you might wish to think about obtaining life insurance on yourself. This can permit you to leave your cash to your partner or kids and get some of your money without having to bother with exactly how they will be able to pay their costs when you no longer are around to do so.

People that choose to obtain life insurance policy as an additional advantage of their last will as well as testament need to take into consideration obtaining life insurance on their partner. You ought to speak to your lawyer concerning your options, yet it can provide an easy way to supply some economic safety and security for them after you have actually gone. Your life insurance plan can likewise cover you for any financial obligations you might have against your estate.

Most individuals that get a life insurance policy plan never ever get the policy on themselves. They simply leave sufficient money in the will to spend for their loved ones. It is not uncommon for relative to utilize this plan as a means to offer the recipients of the will with some of the cash that they would certainly have needed to spend for their living expenses if you had not taken your life.

Some people who obtain life insurance policy have strategies to give several of the cash to their youngsters after they die. If they do not die first, they may not have an opportunity to take the cash out as a result of an impressive financing that they had actually secured. Life insurance policy gives a simple way to do this.

Securing life insurance policy is not a shot in the dark to do, yet there are points that you require to be aware of. For example, not all life insurance policy companies offer insurance coverage for all kinds of expenditures that individuals might incur after they pass away. They might not have the ability to spend for funeral expenses, medical expenses, and much more.

You should see to it that you recognize with the kind of insurance policy that you are obtaining prior to you sign on the populated line. The kind of life insurance that you acquire need to additionally be an excellent alternative for your needs.

When you buy a life insurance policy policy, you must ensure that you have a look at the terms and conditions of the policy. The very initial point that you ought to ask your representative or broker is what the advantages are that you will get for your policy. You require to understand if the advantages are for your dependents, if you can declare a cash value on the plan, or if it will certainly repay any kind of debts.

You will certainly additionally need to take into consideration whether you are going to get a term life insurance plan. Term life insurance policy is similar to the term life insurance policy plan that you get with an employer, but you can claim the survivor benefit rather. You will certainly also require to decide whether you wish to spend the cash in some type of IRA account, or a savings account, or a stock account.

To help you pick between a term life insurance policy policy as well as a whole life plan, you should talk with an economic expert or broker. They can provide you tips regarding which sort of insurance coverage is right for you. and also your circumstance.

Exactly how To Get The Best Life Insurance Policy Policy

Life insurance policy is the most vital element of a retirement. It helps you pay for your liked ones that have died and shields your liked ones from being left in the hands of insurance companies.

When you are preparing to obtain insurance, it is good to take a look at what it can be made use of for as well as what cover it can supply. When you are seeking to get insurance policy differently than the standard, this will aid you ensure that the strategy that you are taking a look at will certainly be the ideal one for you.

It is essential to figure out how long the firm has actually been in business as well as if they are reliable and also trustworthy. Some individuals might discover this details too laborious, yet if you desire the most effective policy for your needs, you need to make the effort to do the study.

What should you think about when trying to find life insurance policy? This is an inquiry that many individuals do not think of, and also they assume that it needs to be affordable, it shouldn't set you back too much, which the firm ought to have an excellent reputation.

There are a lot of firms that offer low cost, affordable policies, but these typically just cover just the prompt household. This is one of the primary reasons that there https://en.wikipedia.org/wiki/?search=life insurance are many people that wind up paying for a plan that they do not actually require.

With a plan that will cover your family members for a certain quantity of money on a monthly basis, you can conserve cash that you would or else spend on other things. It is hard to consider spending a thousand bucks a year, but if you are getting a life insurance plan for that amount of cash, you can consider doing it.

The various other advantage about a life insurance policy plan is that it gives you peace of mind when you need it the most. You are secured when you are not in your house, when you are taking a trip overseas, and you can pay your expenses at the exact same time as you shield your family.

As quickly as you are finished spending for your life insurance policy policy you can kick back as well as not bother with anything since you have a safety net to draw on. If you are wed, it will certainly protect you from separation, if you have children, it will certainly safeguard them from needing to leave residence, and also also if you are a cigarette smoker, it will protect you from illness that smoking cigarettes can trigger.

An insured life insurance policy is also a great investment. It can be made use of to money the future of your family and also ought to be paid on a regular basis to make sure that your household will have something to take place in case of emergency.

Obviously, life insurance is not low-cost, however the firm will certainly pay out some of your costs if you are ill, a target of criminal offense, or a target of natural catastrophes. This is really advantageous to people who have actually lost every little thing and can not consider anything else yet death.

Nevertheless, if you are thinking of getting a life insurance policy, ensure that it is the appropriate one for you. If you pick a plan that has several technicalities as well as the company does not pay on schedule, you will certainly not be able to have peace of mind, and you will wind up being sorry for the decision you made.

As you can see, there are lots of means to obtain a life insurance plan. It will certainly be a good concept to put in the time to contrast a few different plans, find out which one fits your budget as well as requires one of the most, and then opt for the plan that seems ideal to you.

Obtaining Life Insurance Policy Quotes Can Be Testing

Although the principle of life insurance policy has been around for many years, lots of people are not familiar with just how much they need to pay for a policy. The amount you spend for a policy is based upon a number of variables. You need to be aware of these factors prior to acquiring a plan.

Your age will establish your insurance policy costs. Younger individuals are most likely to get in a crash as well as for that reason pay higher premiums. If you are older as well as have no crashes, you may intend to consider getting additional insurance coverage.

You can discover different sorts of plans that cover various kinds of risks. As an example, you can include house and materials insurance coverage to your present policy. This will certainly assist safeguard you in case of your home being destroyed by fire. If you have a second residence, house and components can be included in the plan.

Prior to you purchase a life insurance policy, make certain that it fits your needs. Some policies are too pricey. You might wish to search online as well as find out about the amount of insurance coverage you can get for the amount of money you have actually allocated the http://www.thefreedictionary.com/life insurance policy.

Shopping for a life insurance policy can be hard. A broker will certainly help you locate a plan that is ideal for you. When you have discovered a policy that you can afford, it will be simpler to contrast the rates from various business.

There are various on-line sources where you can get quotes from a selection of firms. You will be able to examine each company's quote and also choose which firm is best suited for you. Compare the amount of insurance coverage supplied by each business.

It is constantly a great idea to know your monthly expenditures before you buy a plan. Your household may alter in the future, as well as this can impact the expense of life insurance policy. Discussing your costs with a broker might offer you a concept of what your premium would certainly be if you had the exact same type of insurance coverage in the future.

If you are wanting to acquire a policy with low premiums but high interest rates, your policy might not appropriate for you. Life insurance policy is developed to aid repay your financial debts if you pass away. When you have a big debt, you will certainly end up paying greater rate of interest on your plan.

When you are purchasing life insurance policy, you might want to request for a quote that consists of every one of the expenses that you would certainly expect to pay for the cover. Some policies only cover clinical costs and not funeral expenses. Both should be divided when you are searching for a policy.

In order to discover the most effective insurance coverage, you must most likely to the workplace of a broker. A broker will certainly find out about the best policies offered as well as will certainly aid you compare the numerous costs that are available. She or he can also assist you to discover plans that include the coverage you require.

Many times people fall short to investigate the policy that they wish to get and end up with a life insurance policy policy that they are not happy with. You need to not enroll in a policy that you do not like. Compare plans to discover the one that ideal fits your demands.

The expense of life insurance policy is a matter of prices. If you want a lower price, you might wish to look around and also obtain quotes from numerous various business. Obtaining insurance policy quotes can be a laborious procedure and you might require to invest a day or more doing this.

Life Insurance Policy - Things to Know Prior To Obtaining a Policy

Life insurance is insurance policy for life. With that being said, you wish to make sure that you are obtaining the best bargain you can. This article is a recap of what we have located up until now. Please understand that this is by no implies a complete list of life insurance policy coverage choices.

There are hundreds of insurance coverage suppliers. As you go about locating the best one for you, you might locate that certain items are not included in your plan. For example, some business will just cover pre-existing conditions. You ought to contact your agent or company regarding this and see if it is covered.

Along with a few of the benefits reviewed here, it is necessary to note that most people do not require the real insurance policy protection that they declare to require. Many people assume that they do require this sort of insurance. However truly, it is essential to recognize that any kind of life insurance policy is just protecting you from the financial debts of your family members.

The insurance provider would not offer you cash for life insurance. They will generally request for an annuity payment that will certainly be provided to your beneficiaries in a round figure. The round figure amount is small, yet the payments are massive once the death benefit has been determined.

Although there are so many choices around, it is wise to shop around and also talk with insurance provider. This way you can find the very best deals and make sure that the insurance coverage you obtain will certainly satisfy your needs. It is additionally wonderful to get the rate quote from a number of various firms to compare as well as find the very best coverage available.

Life insurance is necessary for a variety of reasons. The basic factor is simply to protect your future economic standing. However there are various other advantages that individuals delight in. In this article we have a few of those advantages.

The purpose of life insurance is to offer future security. It is likewise designed to pay if you die. So a good example of why you might need life insurance is if you lose your work. If you require money for a particular period of time before you can get an additional job, then you require to have some type of insurance.

Since it is necessary to have correct life insurance protection, it is vital to shop around and get the most effective rate for your insurance coverage. In this post we have actually checked out the advantage of having a higher costs. Actually, lots of people will make the blunder of picking a reduced rate policy due to the fact that they can afford it. They usually figure out that the premium is much more than they expected.

Some kinds of coverage can likewise help secure your home in the event of an emergency. This is true if you lose your job and also there is a flood or fire that endangers your building. In this situation you intend to get additional protection to make sure that you are not entrusted no economic means to fix the damage done to your home.

Another reason to get life insurance policy is to secure your possessions. Typically the family will offer these assets to pay off bills if there are kids involved. This is a poor concept when it involves your life insurance policy.

Having your own life insurance policy policy is important. Many individuals acquire them due to the fact that they know they will certainly cover their children's university education, their retirement, and also all of their children. Also, they might pick a more youthful recipient. Others may not even make certain what type of protection they require.

For those that are just beginning as well as do not have a great deal of savings, a little bit of life insurance policy protection can be the distinction between life as well as fatality. So, whether you are acquiring a policy on your own or for a buddy or relative, please remember the advantages that this type of insurance policy can offer. Take into consideration the choices that are offered to you, because when it comes to life, you require to see to it that you are covered!

9 Things Your Parents Taught You About life insurance firms ireland

Sorts Of Life insurance policy as well as theBenefits of Each

Life insurance policy is the quantity you pay to have the insurance provider payment your loved ones cash if you are not able to pay them for a particular amount of time. If you are given a death benefit, then this is cash that can be paid to the beneficiary. If you pass away, the recipient will certainly receive a lump sum quantity.

The premiums permanently insurance coverage are incredibly expensive; some insurer require as high as 75% of the survivor benefit to be paid out within the initial year. The settlements may additionally be rolled over right into the 2nd year. You can likewise select from a fixed or variable price policy.

To identify your risk, you will certainly wish to know your level of danger. A lower danger person is a greater costs and also higher risk individual is a lower premium. This is all dependent on the type of coverage you choose to obtain. There are four major types of insurance policy; House insurance, Personal Insurance, Term Life Insurance, as well as Whole Life Insurance Policy.

Term Life Insurance Policy - Term Life Insurance is the least expensive form of insurance policy for you. When you secure a Term Life Insurance Policy Plan, you will certainly make money back after you pass away. This is because the survivor benefit is paid out immediately. With term life insurance policy, the survivor benefit is changed regular monthly based on the existing market rates of interest. An additional great thing about term life insurance is that the premiums are typically much less than the other forms of insurance, which saves you money.

Whole Life Insurance - Additionally referred to as Endowment Life insurance policy, Whole Life insurance policy enables you to buy an endowment of your life and repay the policy on a monthly basis. After you pass away, the plan will pay the beneficiary according to your death benefit quantity. This is one of the most costly kind of insurance policy, and normally comes with a large premium.

Short-Term Policy - Thesepolicies just cover you for a specific quantity of time. They supply no survivor benefit and are more pricey than term policies. Temporary plans are utilized to offer protection during emergency situations or to pay off any debts you might have, generally discovered in your home loan.

Third Party Vehicle Insurance - Protection can be either direct (where the insurance coverage provider pays the case) or Indirect (where you pay the claim). Indirect coverage will pay the claimant in a lump sum repayment if you die, and this can be tax obligation deductible.

Indemnity - This protection offers you defense to your household, including your residence, automobiles, furniture, etc. It can be acquired straight from the insurance provider or you can have it financed.

Home Protection - Protection is generally purchased from the same business that guarantees your home. These policies normally do not supply survivor benefit.

Catastrophic Protection - When you acquire devastating protection, you purchase insurance to shield you from loss of earnings because of illness or unemployment. It is usually non-income bearing, though, so if you lose your task, the premium will certainly still be paid to you.

Long-Term Treatment Insurance Coverage - Long-lasting treatment insurance policy is useful if you have a problem that needs you to remain in a health center or retirement home for extended time periods. There are a selection of problems that can get approved for this protection, consisting of Alzheimer's condition, Parkinson's illness, Autism range problem, Lou Gehrig's illness, Huntington's condition, and numerous sclerosis.

Other Coverage - You can likewise get term life insurance policy that offers coverage for funeral service expenses, medical bills, traveling expenditures, and also some disability benefits. Some insurance companies provide discounts for acquiring your policy with their insurance policy representatives. You must ask about every one of your options and afterwards decide that ideal matches you.

Tips For Obtaining the Best Life Insurance Rates

Life insurance policy is an unpreventable demand, specifically for those who plan to leave their household or services behind as well as their economic events. The options offered are many as well as often can be complicated, especially if you are purchasing insurance policy for the very first time.

There are numerous elements that require to be thought about when acquiring insurance policy such as the individual's requirements, the individual's age, the person's work, the individual's line of work, and also obviously the person's personal funds. There are, nevertheless, some things you can do to reduce the variety of firms you will certainly need to manage. Below are a few pointers.

One of the most essential point you can do is to investigate the firms. You can find this by browsing the net for web sites that offer life insurance. You will be able to get an excellent introduction of the various plans as well as how they are priced. In addition, you will be able to contrast business to establish which one supplies the best advantages.

Particular life insurance suppliers have actually been understood to provide the best value for cash due to the fact that they have good track records and are not understood for high premiums. If you are seeking an excellent business with excellent client service, you should look for service providers that have less than 50 issues against them. Remember, you just require protection if you are going to pass away so it is important that you get what you pay for.

Another idea is to make sure that you buy insurance coverage from a business that has your present postal code. This indicates that any cases will certainly be handled the like if you were to acquire insurance coverage from another company. You will additionally have the ability to search more conveniently since the policy will be sent directly to you.

Investigating online forever insurance policy is really vital. This is because there are numerous business that supply very good life insurance at reduced rates. Many individuals only learn about these business after they have actually made a plan decision therefore it is essential that you do some research study prior to you choose.

One more suggestion to consider is to make use of life insurance policy comparison tools and calculators that can be discovered on the internet. This can assist you compare the various plans and also policies that are readily available.

Remember, that you require to do a good amount of study before you pick a life insurance policy company. Selecting a credible service provider that is certified to supply life insurance in your location is an outstanding method to ensure that you are obtaining the insurance coverage you need.

One of the most effective methods to look for reduced prices is to utilize your regional yellow web pages. A lot of regional phonebook have actually a section committed to insurance, so you need to have no problem discovering a carrier that can give you with the insurance coverage you need.

It is a good suggestion to ask a broker for guidance also. Brokers work for the insurer and also know which plans they like best. They are specialists in this area as well as can generally obtain you a great rate also if you are a new customer.

Before you get life insurance plans, you must consider all of your choices. Lots of people discover that they are better paying a greater costs than purchasing policies from a solitary company. It is challenging to change suppliers when you have a good connection with one but this is not constantly feasible.

Keep in mind, the very best option is to obtain a reduced premium for a long period of time, specifically if you recognize you will be around. You ought to likewise take into consideration switching when you have had a few years with the supplier.

Obtaining A Life Insurance Policy Quote

It is essential that when you get life insurance policy quotes, you locate a company that does not discriminate against your age or sex. Women as well as young people go to a greater threat for death due to the health problems they are prone to. In order to shield your enjoyed ones, it is essential that you obtain a life insurance policy quote for a female.

It is important that when you obtain life insurance quotes, you discover a business that offers life insurance intends that will certainly provide benefits in the event of the death of the insured person. Your household will not be left on a vacant leg of bread in instance of your fatality, but they will certainly obtain assistance in case of your fatality.

When you obtain a life insurance quote, you must also see to it that you locate a firm that uses affordable prices. It is essential that you locate a strategy that will certainly give great insurance coverage for you at an affordable cost. You intend to obtain a price cut for choosing to guarantee your loved ones rather than yourself.

If you want a life insurance policy quote and also are a younger adult, you must make sure that you do not obtain a plan that is too hostile. You want to know that you are insuring your family in instance of your fatality. This is why it is important that you discover a strategy that will give a bargain of insurance coverage.

You may wish to request a cost-free quote from a life insurance policy carrier. This is a fantastic method to see what is available for you as well as how much you will be anticipated to spend for your plan. A variety of service providers use free quotes, so this is a wonderful way to get a strategy that can save you cash when you want life insurance.

When you are looking for a life insurance quote, you might find that you are needed to get a debt check prior to they will grant you a quote. This is a demand that is set by law. You will certainly be needed to show that you are a great threat for the life insurance firm to acquire the policy from.

Many insurance companies that use life insurance policy quotes online base their rankings on just how much cash a client has paid into an interest-bearing account. In this instance, the policy owner is taken into consideration an excellent risk and also the business wishes to make certain that they will not have to pay any kind of expense prices for death or medical costs. This is one manner in which the business can ensure they will make money in case of an individual's fatality.

If you have a poor credit score, you must request a policy as soon as possible. When you obtain a quote, you will be asked if you currently have a life insurance plan. If you do, they will certainly see if you have a low credit report and also if so, you will certainly be asked to send a credit scores report prior to they will supply you a life insurance policy quote.

It is not uncommon for a policy owner to spend time in waiting before they receive a quote. Many carriers only request a quote when a plan prepares to be restored. In other situations, they will acquire a duplicate of your credit rating record to determine if you satisfy their guidelines for paying right into an account. You need to enable yourself adequate time to undergo a credit record prior to you are given a quote.

If you need a quote immediately, you ought to attempt to obtain one by mail. This is the quickest means to receive a quote. Some carriers might call you to get more details concerning your policy. This is a far better alternative than applying for a quote in person.